In the world of digital assets, there’s a notable transformation happening. The recent lawsuit of Ripple Labs versus the Securities and Exchange Commission (SEC) has far-reaching implications for the cryptocurrency industry.

Notably, the ruling has clarified some muddy waters for Bitcoin ATM operators. But how exactly did this happen? Let’s explore.

Understanding the Ripple vs SEC Lawsuit

The Ripple lawsuit has been a landmark case in the realm of digital asset regulation, one that institutional investors and retail investors alike have watched closely.

Ripple Labs and the allegations

The story began when the SEC filed a lawsuit against Ripple Labs under the Securities Act. Ripple, known for its programmatic sales of the XRP token, was alleged by the SEC to have conducted an unregistered securities offering.

The SEC argued that the XRP sales constitute investment contracts. Thereby falling under the purview of securities transactions and, hence, the Securities Exchange Act.

The role of XRP sales

Crucial to the SEC’s argument was the concept of ‘investment contracts.’ The SEC alleged that Ripple raised funds through the sale of XRP tokens to institutional buyers and retail investors.

These XRP sales were more akin to the sales of investment contracts rather than just digital assets. Thus subjecting them to the stringent requirements of securities laws.

The Verdict

Summary judgment

The case went to the Southern District Court of New York, where the summary judgment motions were reviewed by Judge Analisa Torres.

Judge Analisa Torres’ ruling

The court ruled in Ripple’s favor, concluding that the XRP token did not constitute an investment contract under the current interpretation of the Securities Act. Judge Torres noted that the “economic reality” of the XRP sales did not align with the concept of an ‘investment contract,’ therefore exempting them from registration requirements under federal securities laws.

The Implications for the Securities and Exchange Commission

Reassessing the Securities Act

The SEC’s loss implies a need for reassessing the application of the Securities Act and the Securities Exchange Act to digital assets like XRP. This landmark ruling could shape the future of how digital assets are classified under federal securities laws.

Securities Exchange Act and the concept of “Investment Contract”

The judgment adds a new layer of complexity to the definition of ‘investment contracts’ in the context of digital assets. The court’s decision indicates that not all digital asset sales can be considered securities transactions, posing a potential challenge to the SEC’s current regulatory framework.

What This Means for Ripple Labs

Impact on Institutional Sales

This ruling has a significant impact on Ripple Labs, especially regarding its institutional sales. The court’s decision validates Ripple’s position that its sales of XRP did not constitute an unregistered securities offering, a conclusion that could help Ripple Labs increase its institutional sales without fear of violating securities laws.

Ripple’s programmatic sales and the question of ‘unregistered securities offering’

The decision also vindicates Ripple’s programmatic sales approach. The court’s interpretation essentially categorizes Ripple’s sales as a digital asset transaction, not an unregistered securities exchange. This distinction provides a clear path for Ripple to continue its XRP sales without the looming threat of regulatory action for securities violations.

The Ripple Effect on Bitcoin ATM Operators

The importance of ‘regulatory clarity’

The Ripple vs SEC case offers a measure of regulatory clarity for Bitcoin ATM operators. The ruling delineates a boundary between securities transactions and digital asset transactions, a distinction that can help Bitcoin ATM operators navigate the regulatory landscape with greater certainty.

Impacts on the operations of Bitcoin ATMs

By ruling that Ripple’s XRP sales did not constitute an unregistered securities offering, the court indirectly provides a guideline for Bitcoin ATM operators. Operators can now feel more confident that transactions involving digital assets like Bitcoin do not inherently constitute securities transactions, thereby reducing the regulatory risk.

Looking Ahead: The Future of Digital Assets Regulation

Is XRP a sufficiently decentralized digital asset?

Despite the court’s ruling, the conversation around digital asset regulation is far from over. As digital assets evolve, so too will the discussion on their regulatory classification. It raises questions such as: Is XRP a sufficiently decentralized digital asset? If not, what level of decentralization is needed to avoid being classified as a security?

Federal securities laws and digital assets

These questions point to a need for more specific guidance from regulatory authorities like the SEC. Federal securities laws will need to adapt to the realities of digital assets, potentially leading to an updated framework for assessing whether a digital asset is an ‘investment contract’ or not.

The path towards regulatory certainty

For now, though, the Ripple vs SEC ruling provides valuable regulatory clarity. It’s a step towards a more certain future for Bitcoin ATM operators and the broader cryptocurrency industry. The ruling indicates a path that operators and companies can tread, with a clearer understanding of what constitutes an investment contract, and by extension, a security.

Indeed, the outcome of the Ripple vs SEC case shines a light on the potential future of regulatory certainty in the digital assets world. As we tread into this new era, Bitcoin ATM operators and other players in the crypto space can take a cue from this landmark case, learning from Ripple’s experience, and striving for a smoother sail in the vast sea of digital assets.

Follow us on Social Media:

In the meantime, you can follow us on our channels, visit our website, or call us directly!

Check out our website, https://www.chainbytes.com

Give us a call! +1 (415) 529-5777 or shoot us an email.

Related News

Exploring Opportunities: Starting and Growing Your Bitcoin ATM Business

In the rapidly evolving landscape of cryptocurrencies, venturing into the Bitcoin ATM business is an exciting opportunity for entrepreneurs. As digital currencies continue to gain mainstream acceptance, the demand for accessible and user-friendly avenues to purchase...

How To Start And Market a Bitcoin ATM Business In 2024

Are you intrigued by the idea of entering the cryptocurrency market? Have you considered starting a Bitcoin ATM business but feel unsure about where to begin? We'll go over all the steps you need to take to open and sell a Bitcoin ATM business in 2024 in this...

Join ChainBytes at ATMIA Conference 2024

The annual ATMIA conference will take place in Las Vegas on February 14-16. Get ready to embark on an exhilarating journey into the heart of the automated banking industry at the highly anticipated ATMIA (ATM Industry Association) Conference 2024! This annual event...

Order a Bitcoin ATM

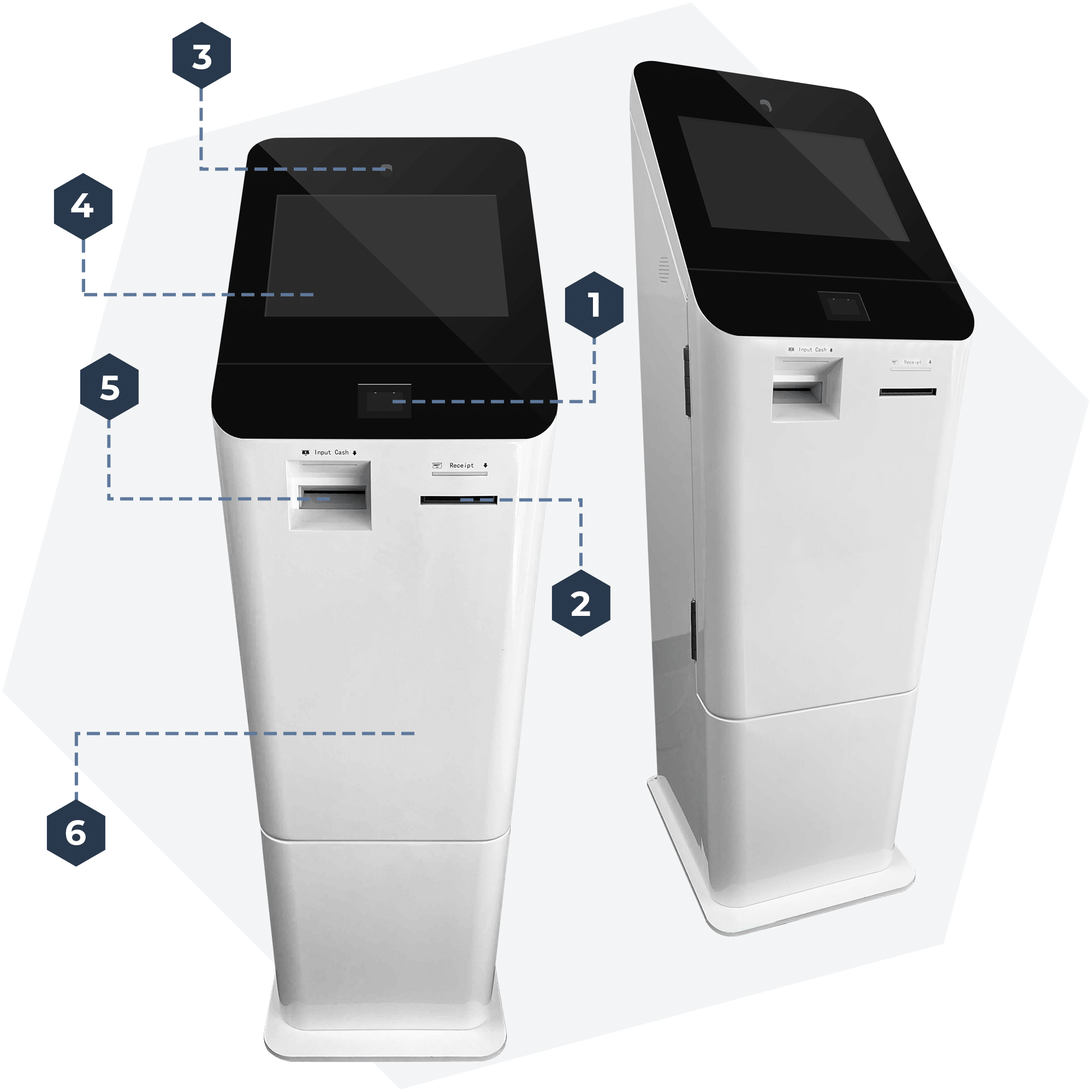

ChainBytes Universal + Top screen

From $6,700

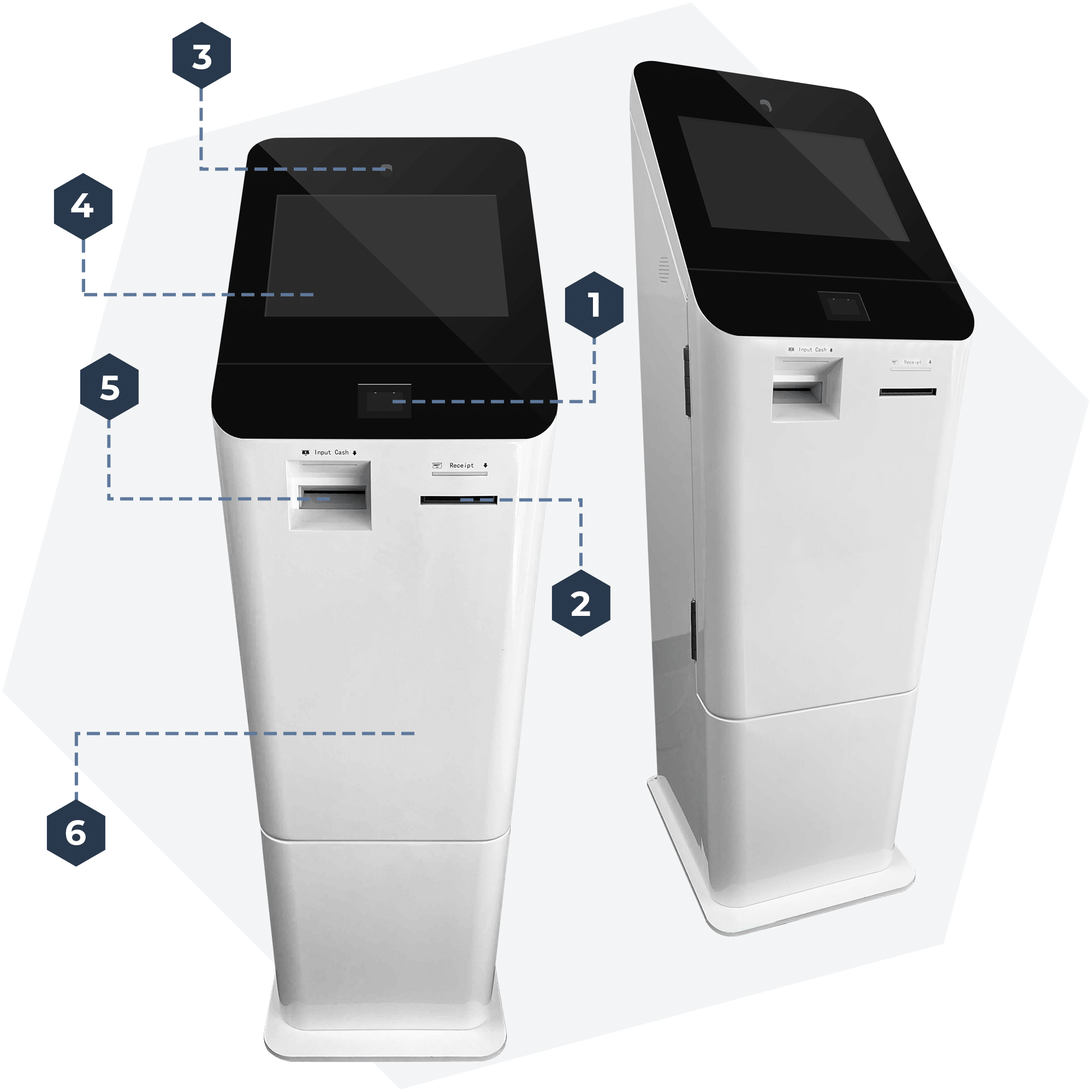

ChainBytes Model V

From $4,999

ChainBytes Model V

From $4,999

ChainBytes Universal + Top screen

From $6,700