The rise of Bitcoin ATMs has revolutionized the accessibility and adoption of cryptocurrencies, offering users a convenient way to buy and sell digital currency with cash. However, behind the scenes, Bitcoin ATM operators sometimes face a challenge, particularly when it comes to securing banking services.

From navigating complex compliance requirements to establishing trust with financial institutions, operators must overcome numerous hurdles to ensure the smooth operation of their businesses. In this blog, we delve into the key challenges of banking in the Bitcoin ATM industry and provide valuable tips and strategies for compliance and acquiring a bank account.

Understanding the Banking Challenges

1. Finding Banks Willing To Work With Bitcoin ATM Operators

One key challenge is finding banks that are willing to open accounts for MSB businesses that Bitcoin ATM operators are. Larger banks are sometimes hesitant to work with Bitcoin ATM operators due to the larger amounts of cash these ATMs generate. In contrast, local banks may be more open to banking Bitcoin ATMs, providing them with a foothold in the banking sector.

2. Risk Assessment and AML/KYC Policies

Banks meticulously assess the risk associated with Bitcoin ATM operators due to the inherent nature of cash-based transactions. Therefore, operators must have robust Anti-Money Laundering (AML) and Know Your Customer (KYC) policies in place to mitigate these risks and demonstrate their commitment to regulatory compliance.

3. Utilizing Cash and Transit Services

To address the challenge of cash handling and transportation, operators can leverage cash and transit services such as armored car operators for secure transportation of funds between Bitcoin ATMs and bank vaults. These services offer a reliable solution while operators work towards establishing traditional banking relationships.

4. Transactional Requirements

Building a customer base and reaching higher transaction volumes is often a crucial step in order to bank with one of the larger banks that are open to MSB business, and establish more favorable banking relationships.

5. Enhanced Due Diligence

One of the main challenges is the enhanced due diligence required by banks. Banks may request specific information, such as lookbacks, or collecting certain information from all the customers.

6. Lengthy Process

The process of acquiring Bitcoin ATM machines, achieving compliance, and securing a bank account can be arduous and time-consuming. It often takes from a couple of weeks to several months to navigate the regulatory landscape and establish banking relationships, requiring patience and perseverance from operators.

Compliance Tips and Strategies

1. Don’t Approach The Bank Until You’re Fully Prepared

A thorough knowledge of KYC/AML program, reporting requirements, and filing procedures is crucial before approaching banks. It is essential to know your operational procedures and best practices.

2. Conduct Regular Compliance Training

Compliance is paramount in the banking sector, and Bitcoin ATM operators must conduct compliance training. Regular compliance training is necessary to ensure operators meet the stringent requirements set forth by regulatory bodies.

This includes initial training on anti-money laundering (AML) procedures, as well as regular supplemental training on industry-specific topics. Another insight is the need to demonstrate compliance with AML regulations to banks. Operators must undergo training and implement measures to prevent money laundering.

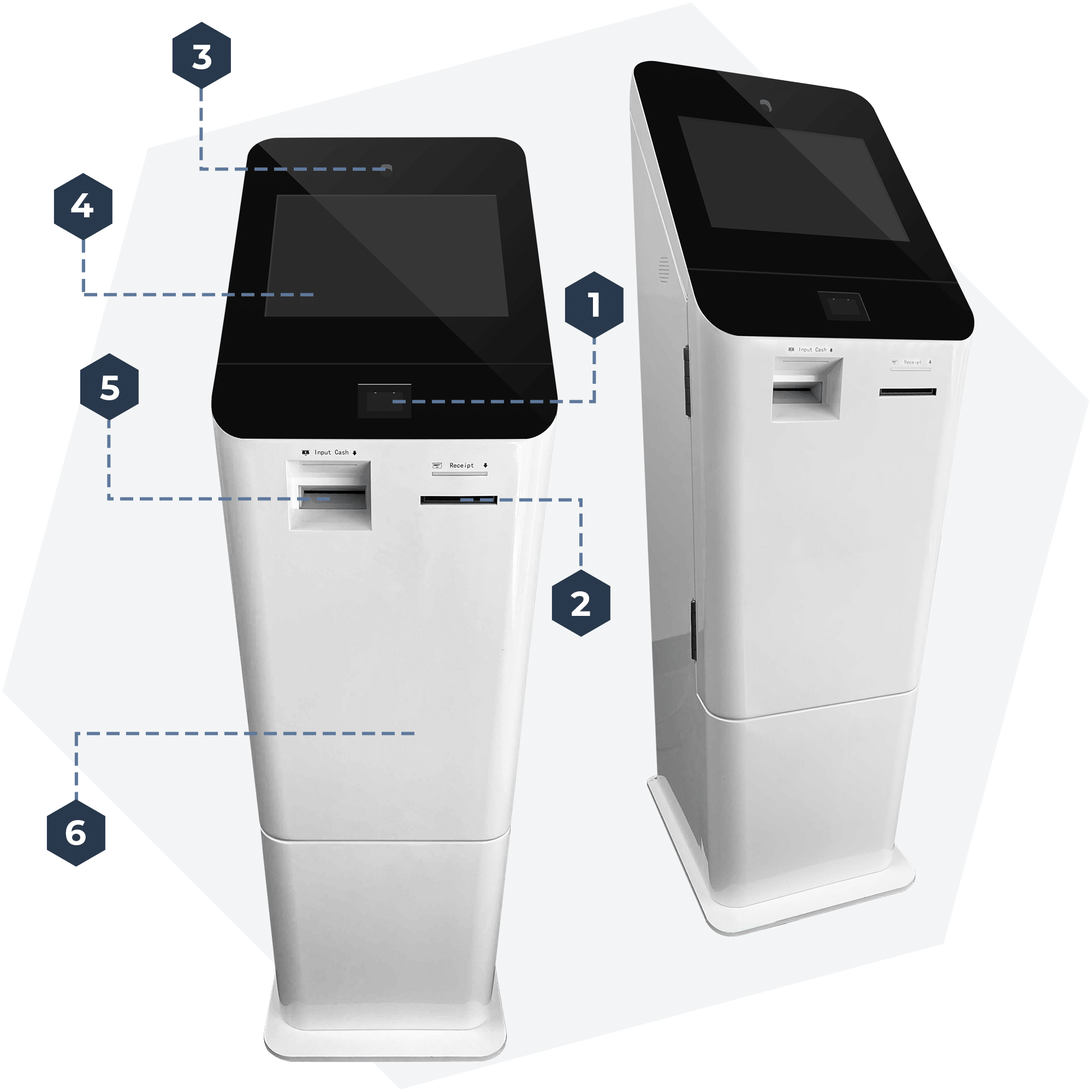

3. Understanding Your Machine’s Functionality

Knowing your Bitcoin ATM machine’s functionality is a key aspect that you need to know while approaching a bank. Operators should have a clear understanding of how the Bitcoin ATM operates, including its features, KYC collection limits, and maintenance requirements. Knowing which cryptocurrencies are supported and sold at the ATM is also important while talking to the banks.

4. Comprehensive AML/KYC Compliance Program:

Implementing robust AML/KYC policies is non-negotiable for Bitcoin ATM operators. These policies among other things should encompass thorough customer KYC, due diligence procedures, transaction monitoring mechanisms, and reporting protocols to detect and prevent illicit activities.

5. Designated Compliance Officer

Designating a compliance officer within the organization is essential for effective implementation of the KYC/AML program. This individual should be well-versed in compliance requirements and responsible for overseeing all aspects of regulatory compliance.

6. Getting A No-Action Letter

Obtaining a no-action and or opinion letter from the state and your legal counsel as well as consulting with an attorney for assistance is very important. This communicates the seriousness of your intentions to run a Bitcoin ATM business in accordance with regulations and aliens with potential legal requirements your state may have implemented.

7. Third-Party Audit

Having a third-party KYC/AML compliance audit completed before approaching the banks is very helpful. This brings credibility to your Bitcoin ATM business which is an important consideration for banks. In addition to this, it also helps you address the things lacking in your compliance program thus helping banks make a favorable decision.

8. Addressing Risk Concerns

The operators in this industry need to understand and mitigate the risks associated with Bitcoin. It is crucial to approach these discussions with a level of knowledge and professionalism to establish a successful relationship with banks. We recommend doing a proper risk assessment before approaching banks and addressing concerns properly to avoid any issues.

9. Getting Two-way Bitcoin ATM Machines

Two-way Bitcoin ATMs can help operators, while one-way machines only accept cash, the two-way machines also dispense cash so the amount of cash that needs handling is reduced because cash inserted by one customer can be dispensed to the next customer for a sell order.

10. Stay Informed About State Regulations

Keeping abreast of federal and state regulations is imperative for compliance. Resources such as the Association of Certified Anti-Money Laundering Specialists (ACAMS) provide valuable insights into regulatory developments at the federal level, while state websites offer information on specific state regulations.

11. Inquire About BSA Requirements

Operators should inquire about the BSA (Bank Secrecy Act) requirements for a money services business when discussing bank account opening with the bank.

12. Blockchain Forensic Tools

The use of blockchain forensic software is becoming a common practice when dealing with cryptocurrency transactions. This is why banks usually ask what tools are you using to monitor the wallets that are conducting transactions.

13. Build Trust with Banks

Building trust and credibility with the banks is crucial for establishing banking relationships. Operators should maintain transparent communication, demonstrate adherence to compliance standards, and emphasize their commitment to operating a legitimate and compliant business.

In conclusion, banking challenges in the Bitcoin ATM industry stem from the unique nature of cash-based transactions and banks’ risk aversion towards cryptocurrency-related businesses. However, operators can navigate these challenges by staying informed about regulatory requirements, implementing robust AML/KYC policies, and fostering trust with financial institutions. Bitcoin ATM operators can mitigate risk and ensure the long-term viability of their businesses in this dynamic and evolving industry.

Lastly, operators like Hippo ATM can successfully overcome these challenges by utilizing the latest technology from trusted providers like ChainBytes. ChainBytes is dedicated to supporting its clients every step of the way, ensuring that each Bitcoin ATM operator can thrive in this dynamic industry.

Ready to start your Bitcoin ATM business? Contact ChainBytes today and take the first step towards setting up a successful Bitcoin ATM operation in 2024.

Order a Bitcoin ATM

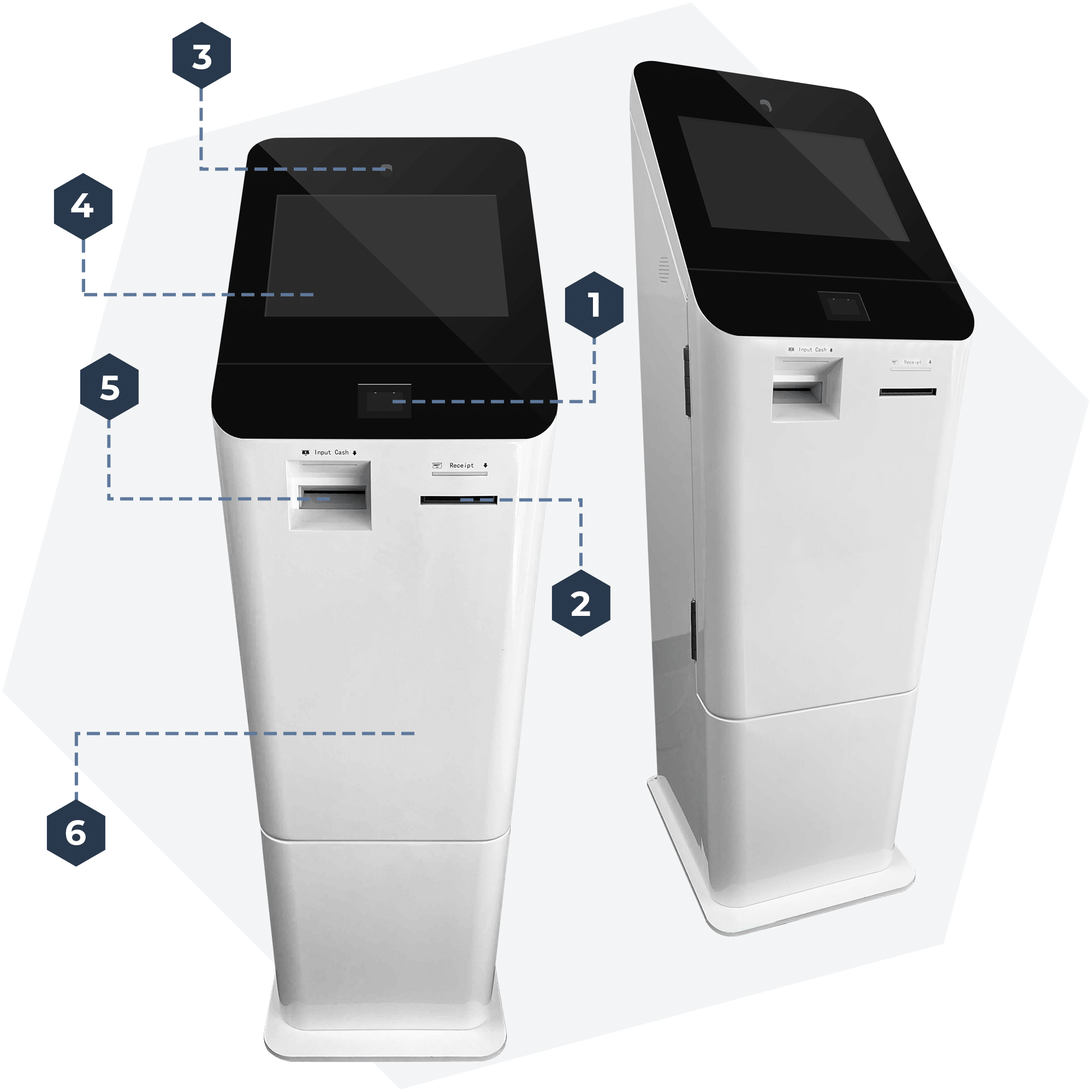

ChainBytes Universal + Top screen

From $6,700

ChainBytes Model V

From $4,999

ChainBytes Model V

From $4,999

ChainBytes Universal + Top screen

From $6,700

Follow us on Social Media:

In the meantime, you can follow us on our channels, visit our website, or call us directly!

Check out our website, https://www.chainbytes.com

Give us a call! +1 (415) 529-5777 or shoot us an email.

Related News

Tips & Tricks to Become a Successful Bitcoin ATM Operator

The cryptocurrency market offers exciting opportunities for entrepreneurs, with the Bitcoin ATM business standing out as particularly promising due to the increasing global adoption of digital currencies. Bitcoin ATMs facilitate the buying and selling of Bitcoin and other cryptocurrencies, bridging the gap between digital and traditional transactions. Success in this industry requires strategic planning, effective execution, and ongoing management. This guide covers essential tips, including understanding market trends, selecting the right ATM, securing funding, choosing ideal locations, ensuring regulatory compliance, and providing excellent customer support, all crucial for thriving in the Bitcoin ATM business.

Exploring Top Bitcoin Business Opportunities

The cryptocurrency revolution has unlocked numerous business opportunities, with Bitcoin at the forefront as the most recognized digital currency. Entrepreneurs globally are leveraging Bitcoin’s decentralized nature and increasing adoption to innovate. This article explores the top 5 Bitcoin business opportunities for 2024, offering insights into their potential and steps to get started, including Bitcoin ATMs, mining operations, education services, merchandising, and exchange platforms.

The cryptocurrency revolution has opened up numerous business opportunities, with Bitcoin leading the charge as the most recognized and valuable digital currency. Entrepreneurs worldwide are leveraging Bitcoin’s decentralized nature, robust security, and growing adoption to create innovative business models. This article delves into the top 5 Bitcoin business opportunities for 2024, offering insights into their potential and how you can get started.

Benefits of Adding a Bitcoin ATM To Your Business

In recent years, cryptocurrencies have surged in popularity, driving demand for easy ways to convert fiat into crypto. Bitcoin ATMs (BTMs) have emerged as a convenient solution, allowing users to purchase cryptocurrencies with cash. According to CoinATMRadar, over 38,000 Bitcoin ATMs are active across 70 countries, highlighting a significant business opportunity. This blog explores the potential benefits of incorporating Bitcoin ATMs into your business