Introduction

As our global financial system continues to transform, spurred by the advent of financial technology, there’s a rising focus on bringing cryptocurrency to all corners of society. However, a significant portion of the population – the underbanked and unbanked – still stands at the fringe of this transformation.

This group struggles to gain access to traditional bank accounts and therefore is often dismayed from participating in new digital wave or blockchain and Bitcoin.

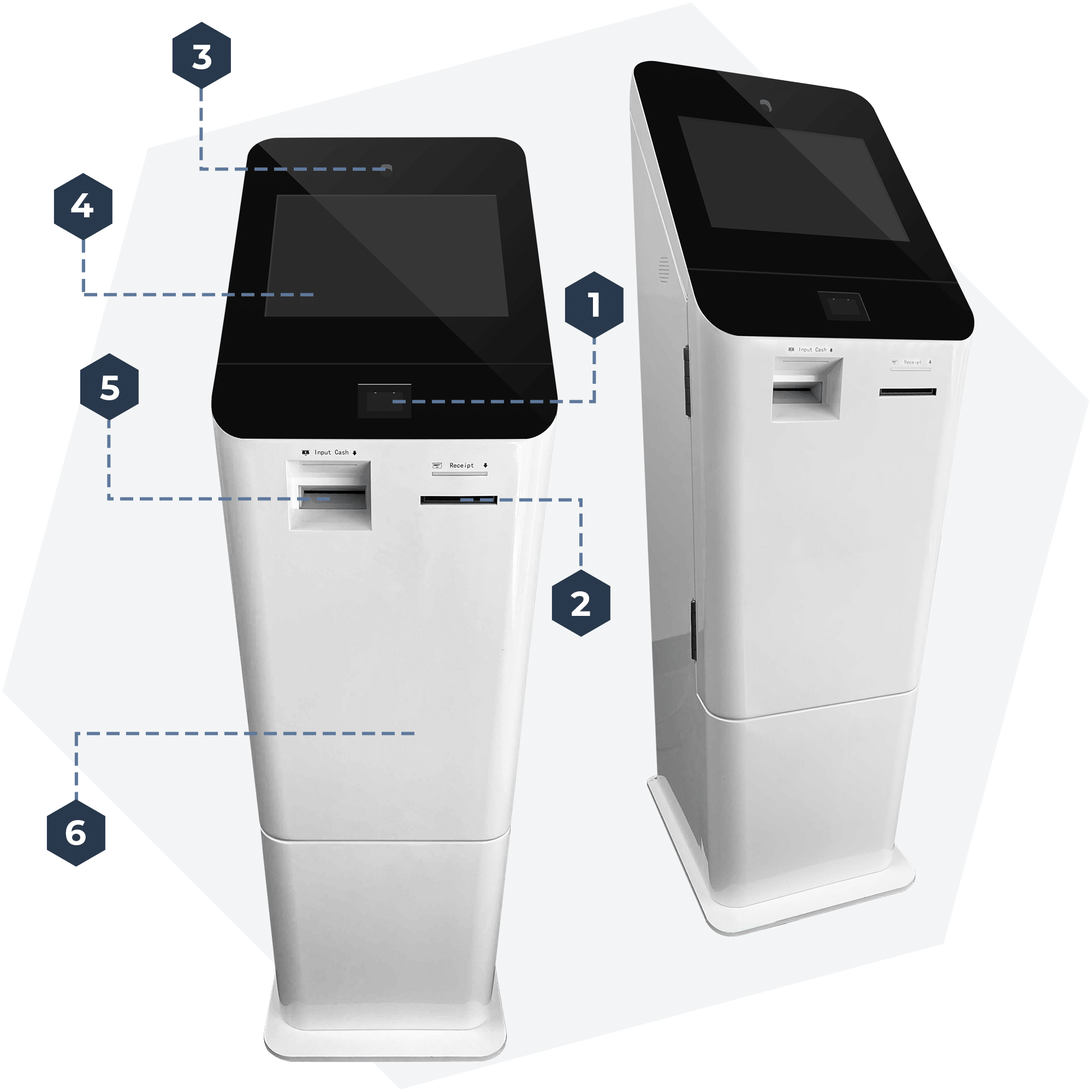

Enter Bitcoin ATMs – an innovative fusion of innovation and decentralized technology. These machines, much like traditional ATMs, offer a pathway for marginalized communities to partake in the growing digital economy.

The Unbanked and Underbanked Problem

According to the Federal Deposit Insurance Corporation (FDIC), as of their latest survey, about 5.4 percent of U.S. households were unbanked, equating to approximately 7.1 million households. In contrast, an additional 18.7 percent of households (24.2 million) were underbanked. These figures are even more pronounced among lower-income households and Hispanic households.

The unbanked and underbanked often have limited options in the realm of financial services:

- Nonbank transaction services: Including money orders and check cashing services,

- Alternative services: Like Western Union, MoneyGram, or Ria.

These services often come with high fees and restrictive terms. Traditional financial services remain elusive for these individuals due to factors such as minimum balance requirements, trust issues with banks, poor credit history, and even geographic barriers.

How Bitcoin ATMs Bridge the Gap

Bitcoin ATMs can help mitigate digital inclusivity challenges in several ways:

- Easy Access and Use – These machines provide an intuitive way for users to buy or sell bitcoins. It’s as straightforward as using a regular ATM – to purchase the Bitcoin all that is needed is cash and a personal Bitcoin wallet address (For larger purchases other information may be required for example an ID, phone number, etc.)

- Overcoming Traditional Barriers – With no need for a bank account or credit checks, Bitcoin ATMs provide an accessible way to procure Bitcoin.

- Increasing Presence – The number of Bitcoin ATMs is increasing globally, thus expanding inclusion by bringing an easy onramp to crypto closer to the unbanked and underbanked population.

The Role of Bitcoin ATMs in Economical Health

Beyond immediate access to cryptocurrency, Bitcoin ATMs offer long-term benefits to the unbanked and underbanked:

- Independence: Access to Bitcoin ATMs encourages cryptocurrency independence and literacy. It exposes individuals to the broader system, allowing them to partake in the new cryptocurrency trends and potentially escape the cycle of reliance on high-cost alternatives.

- Broadening Savings Opportunities: Bitcoin ATMs offer the opportunity for unbanked and underbanked individuals to use their physical cash and purchase a Bitcoin, which has the potential for value growth over time. This presents a new avenue for saving and wealth accumulation. But individuals partaking in this new world of cryptocurrency need to be aware that the value of cryptocurrency can go up or it can easily go down, so before investing in crypto always ensure that you know the risks, and always do extensive research.

Exploring the World of Alternative Services: Bitcoin ATMs and More

In the quest to expand inclusion for the unbanked and underbanked, the role of alternative options has become increasingly significant. Among these providers, Bitcoin ATMs have emerged as key players for easy onboarding to crypto.

Diverse Nonbank Services

Alternative financial service providers offer a range of nonbank services that can cater to those struggling with traditional bank account access:

- Check Cashing Services: Businesses that cash checks for a fee are often more conveniently located and have more flexible hours than traditional banks.

- Nonbank Online Payment Services: Services like PayPal allow for convenient money transfers and online payments.

- Prepaid Debit Cards: Prepaid cards provide a way to store money and make electronic payments, including online purchases, without needing a traditional bank account.

Complementing Bitcoin ATMs

While each of these alternatives has its advantages, they also come with their own limitations. Check cashing services often impose high fees. Prepaid debit cards come with their own limitations. Nonbank online payment services require internet access, which can be a barrier for some. But none of these alternatives offer an easy way for the unbanked to partake in the cryptocurrency world.

Bitcoin ATMs, with their easy-to-use interfaces and the ability to sell you Bitcoin locally, can help fill some of these gaps. They offer a way for individuals to enter the digital crypto world without the need for online registrations or accounts.

The Future of Digital Inclusion: Integrating Bitcoin ATMs

While Bitcoin ATMs offer an easy way to onboard to crypto, the challenges faced by the underbanked and unbanked and the goal of digital inclusion are more complex.

Enters a technological revolution.

In this digital age, technology is set to play a pivotal role in driving digital inclusion. Mobile banking, online banks, and other fintech solutions are breaking down barriers to financial services. On the other hand, Bitcoin ATMs are a prime example of the technology revolution in the cryptocurrency world.

The Road Ahead: Expanding Digital Inclusion

While Bitcoin ATMs provide a promising path toward crypto inclusion, it’s essential to recognize that they are just one part of a broader solution. The task of integrating the unbanked and underbanked into the digital system will also involve traditional banking institutions, credit unions, fintech companies, and regulatory bodies.

Through collaboration and innovation, we can hope to construct an inclusive economic system that caters to all, irrespective of their banking status. The growth of Bitcoin ATMs represents a significant stride in this direction, propelling us towards a future where everyone can fully participate in the digital age.

As we continue to measure digital inclusion, the spotlight will undoubtedly fall on the role of Bitcoin ATMs to provide ease of access to crypto. Despite the challenges that lie ahead, the convergence of cryptocurrency and technology brings us closer to a world where no one is left behind.

Host a bitcoin ATM at your location

Follow us on Social Media:

In the meantime, you can follow us on our channels, visit our website, or call us directly!

Check out our website, https://www.chainbytes.com

Give us a call! +1 (415) 529-5777 or shoot us an email.

Related News

Venezuelan Government Launches State Backed Crypto Remittance Platform

After imposing new tax regulations on incoming remittances, the Venezuelan government launched its own remittance platform. However, the only supported currencies, besides the Venezuelan Bolivar (VES), are Bitcoin and Litecoin. Migrant workers abroad can send...

Canada Revenue Agency Research: Bitcoin ATMs Increase Store Traffic

Canada Revenue Agency Determined that Bitcoin ATMs Increase Store Traffic.

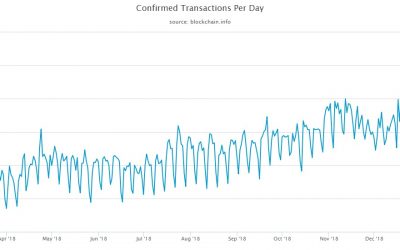

Bitcoin Transactions Reaching All Time Highs

The amount of confirmed Bitcoin transactions have been steadily rising, reaching levels that were only seen during the cryptocurrency craze of late 2017.

Order a Bitcoin ATM

ChainBytes Universal + Top screen

From $6,700

ChainBytes Model V

From $4,999

ChainBytes Model V

From $4,999

ChainBytes Universal + Top screen

From $6,700