Digital currency usage has drastically changed in recent years. At the forefront of this revolution are Bitcoin ATMs. Instead of being simple ATMs, these are entry points into the world of cryptocurrencies. Let’s examine this technology’s quick development in more detail and recognize its significance for the existing financial system.

Introduction: The Dawn of a New Financial Era

Imagine walking into a grocery store or gas station, and instead of seeing the familiar green and blue of traditional ATMs, you’re greeted by a sleek machine offering you the chance to buy or sell Bitcoin instantly. It is currently occurring all across the world; this is not a scene from a sci-fi film. The proliferation of Bitcoin ATMs has made purchasing crypto as easy as buying a soda.

The Basics: What is a Bitcoin ATM?

How Bitcoin ATMs Work

- Bitcoin ATMs offer a physical point of interaction for users to buy and sell Bitcoin.

- These ATMs offer immediate access to digital money, without the requirement for a bank account, in contrast to online crypto exchanges.

- Users typically scan a QR code with their phone of their digital wallet address, undergo a quick identity verification, and then proceed with their financial transactions.

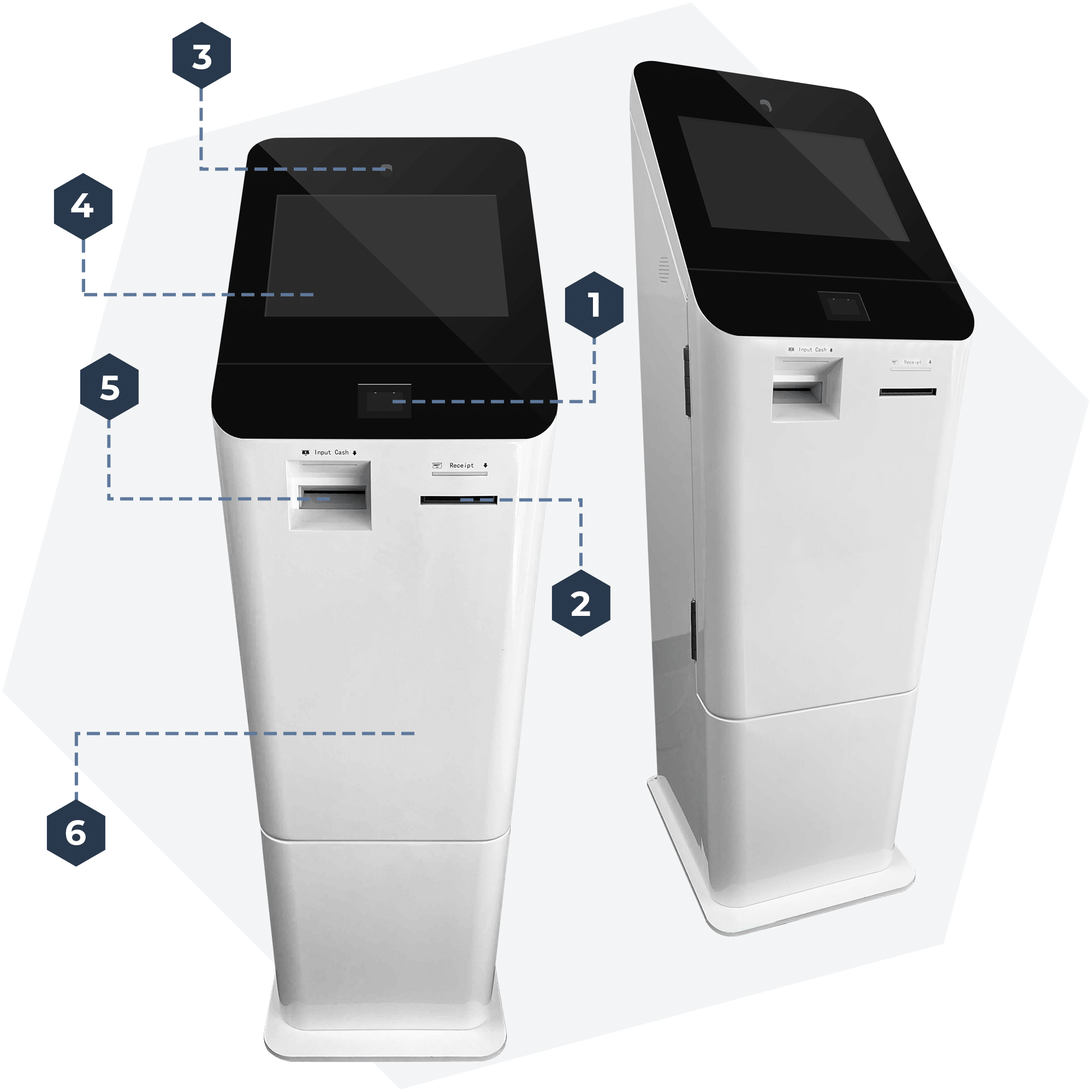

Key Features of Bitcoin ATMs:

- Bi-directional Functionality: Many machines allow users to both buy Bitcoin and sell Bitcoin, offering a two-way street for cryptocurrency transactions.

- User-friendly Interface: Designed for both crypto enthusiasts and novices, the user interface of ChainBytes Bitcoin ATMs is intuitive and easy to navigate.

The Global Spread: Bitcoin ATMs on the Rise

The data speaks for itself. A map of a Bitcoin ATM would show pins strewn over continents, demonstrating how widely accepted these devices are. Here’s a closer look at the numbers:

- Bitcoin ATMs: With an incredible development pace, there are presently tens of thousands of Bitcoin ATMs spread over the globe.

- Crypto ATMs: Now that these gadgets can support additional cryptocurrencies in addition to Bitcoin, their usefulness has been substantially increased.

- ATM Operators: The market is consolidating, and we are seeing big movement, some of the new companies are taking a big share of the market, but one is certain there are more and more Bitcoin ATMs deployed by the day and yet they are not nearly enough to satisfy ever-growing interest of the customers seeking to quickly buy Bitcoin near them.

Why the Sudden Surge?

- Accessibility: Bitcoin ATMs offer a convenient way for individuals without a bank account or those wary of online crypto exchanges to engage in Bitcoin transactions.

- Anonymity: While operators require identity verification, they still provide a higher degree of privacy compared to online exchanges and their KYC/AML systems.

- Instant Transactions: No more waiting for bank transfers or exchange approvals. Bitcoin ATMs deliver immediate results.

Bitcoin ATMs and the Consumer Experience: A New Frontier

Easy way to get Crypto

Getting Bitcoin via Bitcoin ATMs have become easier than ever before. Operators can set up their kiosks in no time and ensure that their customers are having the best experience. By providing advanced back office managing platform called “Dashboard” ChainBytes has enabled its operators to easily adjust all the aspects of their operation. Here are a few examples of KYC personalizations created to respond to your company’s needs:

- Digital Wallet Integration: By connecting directly to an operator’s digital wallet, Bitcoin ATMs provide a seamless transaction experience. ChainBytes do not hold your funds or your private keys, operators are owners of their funds and they are holding their funds and are fully responsible for their keys. Do not forget your keys for your Bitcoin!

- Customer key: Provide a unique QR code to your known and trusted customers and they will be able to perform purchases faster and without a need to scan their ID over and over again.

- QR Code Scanning: Easy way for customers to scan their wallet via camera or 2D scanner.

- KYC: ChainBytes Dashboard allows operators to setup their KYC in a way that best suits their AML/KYC program. You can request phone number, ID, SSN, or other personal information directly via Bitcoin ATM by setting up KYC limits. This ensures that customers have a seamless experience at the ATM and that you do not need to call the customer after every single transaction.

Extending Cryptocurrencies’ Impact

As more and more places, like gas stations and grocery stores, install Bitcoin ATMs, the common individual will have easier access to cryptocurrencies and they will seek for convenience and good customer support.

- ATM Operators: The growth in the number of ATM operators has led to increased competition and better services. Currently, traditional ATM operators are slowly expanding their portfolio adding Bitcoin ATMs to their business. Why? Because the profit on a $1,000 withdrawal from a traditional ATM is nowhere near the profit Bitcoin ATM operators see when they sell a $1,000 worth of Bitcoin.

- Crypto ATMs: Today we would say no one cares, because Bitcoin is the main brand and people seek for a Bitcoin ATM near them that will be operational and where they can easily buy or sell their Bitcoin and be on their merry way.

- Bank Account Information: Keep them safe! Since Bitcoin ATMs do not need any Bank account information, customers have additional peace of mind not needing to worry about the exposure of their bank account.

Educating and Empowering Users

Bitcoin ATMs are not just transaction points; they are educational hubs that empower users to engage with digital currency.

- How Many Bitcoin ATMs?: Users now have additional opportunities to learn about and interact with cryptocurrencies because of the rise in ATM availability.

- Best Advice and Support: Many Bitcoin ATMs provide information and support, guiding users through the process. ChainBytes ATMs have an additional top screen that can be used for promotional or educational purposes.

- Content Created for Users: From tutorials to FAQs, Bitcoin ATMs often offer content that educates users about crypto transactions.

Challenges and Considerations

While the growth is impressive, it’s essential to understand the challenges and considerations associated with Bitcoin ATMs:

- Transaction Fees: Users might encounter high transaction fees at ATMs, especially when compared to online crypto exchanges. These fees are operator profit and currently, we are seeing fees going anywhere between 15-20%.

- Regulations: With the financial crimes enforcement network and other regulatory bodies keeping a close eye, Bitcoin ATM operators need to ensure they’re compliant with the Bank Secrecy Act and other relevant regulations. There are specialized companies that can help operators get started, prepare the AML/KYC programs, and register operators with FinCEN. One of the companies specializing in Bitcoin ATM KYC/AML is www.btmcompliance.com

- Security Concerns: Like any financial system, there’s always a risk of criminal activity. Operators and users should be cautious and ensure to prevent any attempt of malicious use of a Bitcoin ATM.

- Debit Card Usage: Bitcoin ATMs do not accept credit or debit cards. Bitcoin transactions are not reversible, therefore any credit card instant purchase would open operators to the possibility of chargebacks and loss. While with time, those risks can be mitigated, the issue of finding a bank that will bank a credit card power Bitcoin ATM still remains.

- Transaction Limits: Depending on the ATM and the level of identity verification, transaction limits may vary. Operators set their own limits as per their KYC/AML program.

The Future: What Lies Ahead for Bitcoin ATMs?

The world’s leading Bitcoin and crypto experts believe that as digital currency becomes more mainstream, the demand for physical transaction points like Bitcoin ATMs will only grow. Here are some predictions:

- Expansion to Specialty Shops: Expect to see Bitcoin ATMs in more specialty shops, grocery stores, and gas stations.

- Integration with Traditional Banking: As the lines between digital currency and fiat currency blur, we might see a fusion of traditional ATMs with crypto kiosks. We may still be far from such fusion but crypto is heading in a good direction.

- Advanced Features: Future Bitcoin ATMs will offer more advanced features, leveraging blockchain technology provider insights to offer additional services. ChainBytes Bitcoin ATMs are built in a way that can support additional features that may come over the years.

Conclusion: Accepting the Revolution in Digital Currency

The currency’s expanding popularity and a broader shift toward a more open and decentralized financial system are both shown by the rapid growth of Bitcoin ATMs around the world. One thing is certain as we stand at the beginning of this revolution: traditional banking and blockchain-based technology will continue to coexist.

Whether you are an experienced blockchain expert or someone who is just dipping your toes into the world of digital currency, the proliferation of Bitcoin ATMs heralds a new era of accessibility and easiness. These devices establish a tangible connection to a digital phenomenon by bridging conventional banking with the cutting-edge world of cryptocurrencies while providing a great source of income for the operators.

Follow us on Social Media:

In the meantime, you can follow us on our channels, visit our website, or call us directly!

Check out our website, https://www.chainbytes.com

Give us a call! +1 (415) 529-5777 or shoot us an email.

Related News

Webinar Highlights: How To Start & Grow Your Bitcoin ATM Venture

Wrapping up the year with our final webinar, we took a moment to reflect on an engaging session filled with insights and opportunities. As Bitcoin recently surpassed the monumental $100k mark, interest in the cryptocurrency industry is soaring, making now an ideal...

Tips for Seamless Customer Support in the Bitcoin ATM Business

Effective customer support is crucial for any business, and the Bitcoin ATM industry is no exception. With the growing popularity of cryptocurrency, users increasingly rely on Bitcoin ATMs for quick and easy transactions. However, as with any new technology, customers...

Key Considerations for Investing in Cryptocurrency ATMs

In the evolving world of finance and technology, cryptocurrency ATMs are becoming increasingly popular. These machines offer a tangible interface between the digital and physical realms of finance, allowing users to buy and sell cryptocurrencies with ease. As an...

Order a Bitcoin ATM

ChainBytes Universal + Top screen

From $6,700

ChainBytes Model V

From $4,999

ChainBytes Model V

From $4,999

ChainBytes Universal + Top screen

From $6,700