As the world becomes more digitally driven, more and more people are turning to Bitcoin as a means of investment rather than a traditional bank. The rise of Bitcoin has caused many to question the role of banks in the future of finance.

With governments all over the world looking into creating the so-called “centralized bank digital currency” to combat crypto, people have become divisive about whether to trust in the crypto market or let the central bank keep people’s money.

If you find yourself in a rut, wondering what the future brings for banks and Bitcoin, this is the perfect article for you.

In this article, we will explore the benefits of Bitcoin over traditional banking methods and why people are choosing to invest in it.

Why Bitcoin is Being Preferred Over Saving in Banks

Bitcoin is quickly becoming one of the most attractive investment opportunities available due to its decentralized nature, global accessibility and transparency. Unlike traditional banking methods, which can be limited by geographical location or other restrictions, Bitcoin is accessible from anywhere in the world, at any time.

Additionally, it provides a level of transparency and accountability not always possible with traditional financial institutions, as all transactions are recorded on a public ledger. Furthermore, Bitcoin is not subject to inflationary pressures that can cause the value of traditional finance to decrease over time. For these reasons and more, investing in Bitcoin is an increasingly popular option for those looking for greater control over their finances.

Centralization of Banks and Custody Over Money

In these uncertain times, it’s more important than ever to be aware of how secure people’s money really is. With banks, the stability and trustworthiness of the institution should be a major factor in deciding where people store their money. Banks can fail without warning, leaving customers without their hard-earned savings and investments.

Additionally, central banks may enforce limits on how much money individuals can withdraw from their accounts, potentially exposing them to financial losses if they haven’t taken action to secure their funds beforehand.

Individuals who prioritize financial autonomy and security can find this in Bitcoin. Digital assets are viewed as digital gold by the crypto sector because they provide individuals with complete control over their funds without the need for third-party intermediaries such as banks. This is especially beneficial in times of economic crisis or instability, where central banks may limit how much money people can withdraw from their own accounts. Bitcoin can be seen as a safe haven as it offers a level of protection not seen with traditional banking methods.

Self-Custody for Money through Bitcoin

Bitcoin provides a means of self-custody for money. With Bitcoin, people have access to their funds at all times, and they do not have to worry about banks or other financial institutions having control over their funds. Additionally, while the use of Bitcoin is not completely anonymous, it still provides a level of privacy that is not possible with traditional banking methods.

IMPORTANT: Why a Bitcoin ATM is Safer than a Crypto Exchange

Having self-custody on Bitcoin depends on where the person buys it from. Centralized crypto companies can act no different from traditional banks because they hold users’ cryptocurrencies. If that company crumbles and declare bankruptcy, people (including crypto clients, traders and retail investors) may not get their money back.

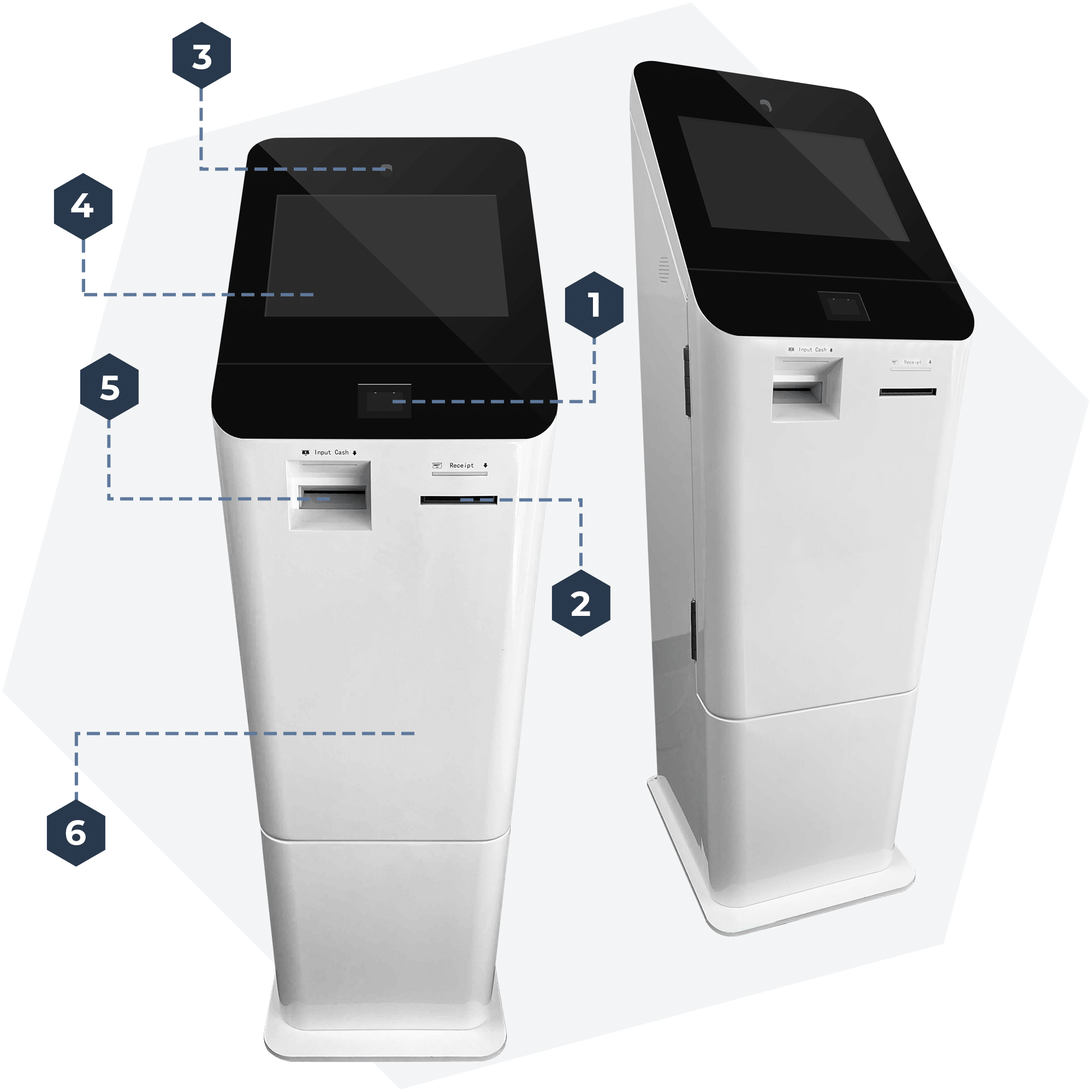

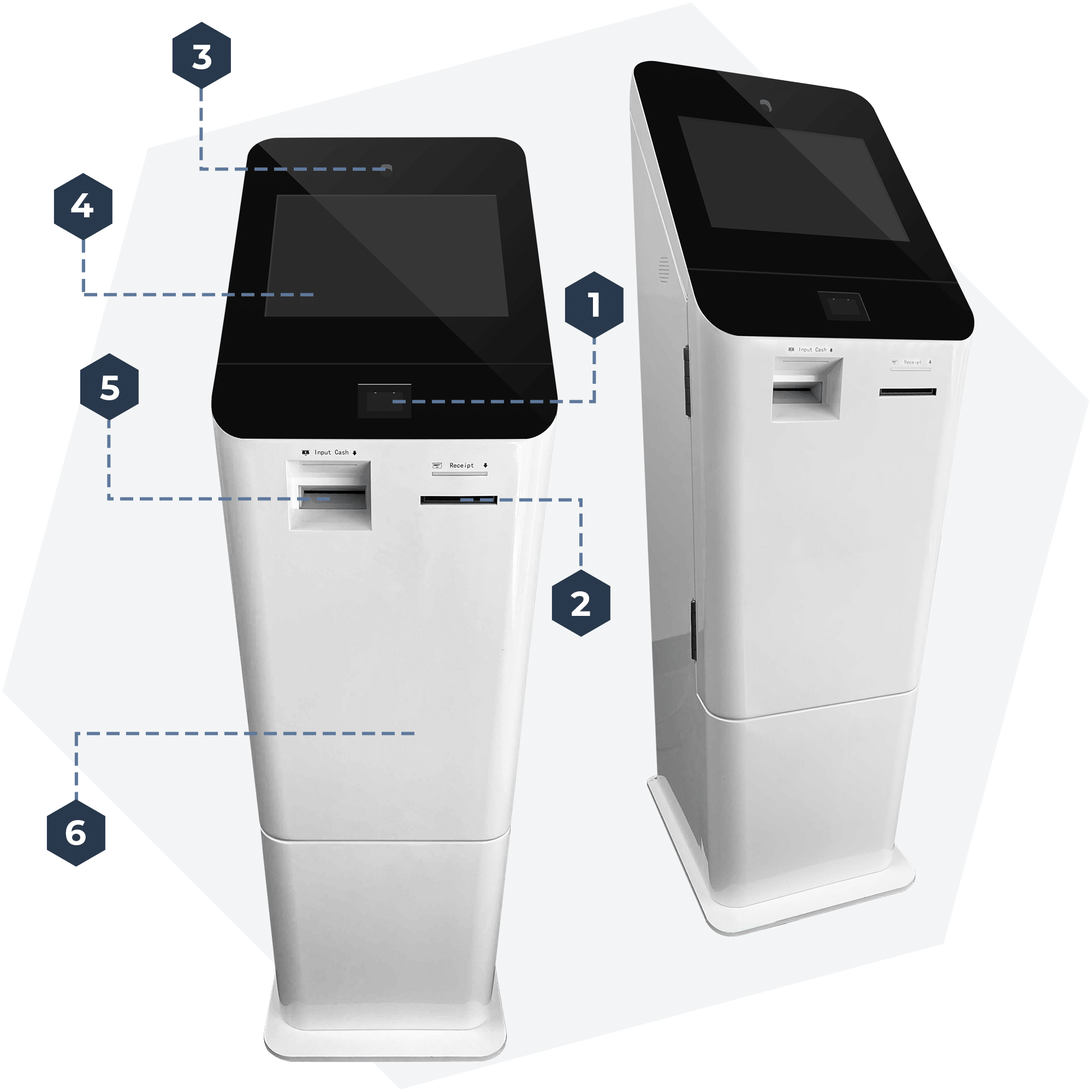

But if the person buys it from a Bitcoin ATM instead, they own their digital assets 100%. Think of the machine as a sort of vending machine for snacks. You insert cash in it, it gives you the snack you want. Once you claim it, it’s yours even if the machine busts down.

For example, ChainBytes manufactures top-of-the-line Bitcoin ATMs for people to buy and sell Bitcoin in a short amount of time (we’re talking less than a minute just to complete a transaction). The machines let people keep their Bitcoin forever as long as they properly store their wallet. Even if the company closes down, nothing will ever take away the person’s crypto purchase.

In other words, once someone buys Bitcoin from it, their digital assets are theirs to keep in their crypto wallets.

Comparison of the US Dollar and Bitcoin

The value of the US dollar is determined by a number of factors, such as the strength of the US economy and the policies of the Federal Reserve. In contrast, Bitcoin’s value is determined by supply and demand. Due to its limited supply and increasing demand, Bitcoin has experienced a sharp rise in value over recent years.

Investing in Bitcoin

Investing in Bitcoin and digital currencies carries some risk but can potentially bring significant returns. People are investing in it to diversify their portfolios and protect against inflationary pressures. Even small investments could result in considerable profits down the line.

The Future of Banks

Banks are still an important player in global finance, but their future is uncertain as decentralized systems like Bitcoin gain traction. Many questions have arisen about how banks will adapt to these changes moving forward.

The closure of Signature Bank and Silicon Valley Bank in early 2023 left a deep impression on banking services everywhere. Very rarely do two national banks close simultaneously like this.

The Future of Bitcoin

It’s impossible to be certain, but many experts believe that Bitcoin has what it takes to become a global currency in time. Its decentralized structure makes it more secure than traditional banking methods, while its limited supply adds stability not found with regular currency exchange rates.

The US Securities and Exchange Commission (SEC) has increased oversight for crypto-related industries due to concerns about violations (such as unregistered ICOs). Banking regulators have also been paying close attention to cryptocurrencies, raising warnings around risks connected to money laundering or terrorism financing while also recognizing potential benefits these technologies might offer. Some companies even recognize those benefits, offering banking services specifically designed for digital asset companies or cryptocurrency firms.

Bottom Line

Bitcoin has been around for over a decade now and is proving to be much more than just a passing trend. After gaining a steady footing in the market, it has become an increasingly popular form of investment and asset class – one that is gaining traction with investors and businesses alike. Its unique properties make it attractive to those who want control over their money and the ability to easily transact within a secure network.

Bitcoin also offers privacy protections that traditional financial institutions cannot match, as well as unmatched speed and low-cost transfers when compared to other forms of money transfer. In short, Bitcoin is here to stay and looks set to continue its upward trajectory in the years ahead.

Become a Bitcoin ATM Operator Today with ChainBytes

Becoming a Bitcoin ATM operator with ChainBytes can be a great way to contribute to the growing cryptocurrency industry. By providing people with the option to buy Bitcoin on-site, you can help to make this revolutionary financial system more accessible to the general public. Don’t wait any longer to get started, become a Bitcoin ATM operator with ChainBytes today!

Follow us on Social Media:

In the meantime, you can follow us on our channels, visit our website, or call us directly!

Check out our website, https://www.chainbytes.com

Give us a call! +1 (415) 529-5777 or shoot us an email.

Related News

Bitcoin ATMs Skyrocket as Crypto Goes Mainstream

Bitcoin ATMs Skyrocket as Crypto Goes Mainstream As cryptocurrency like Bitcoin is gaining wider adoption, the numbers of Bitcoin ATM (BTM) has skyrocketed. According to data (Bitcoin ATM Installation Growth) from Coin ATM Radar, the number of BTM has increased from...

Bitcoin Public Keys And Private Keys

After buying your first Bitcoin, you realize new terms you have never heard before using cryptocurrency. Most new users are already familiar with a digital wallet, but what are “private keys” and “public keys”? Then you realize that these are essential components of...

Why ChainBytes ATMs are the Bitcoin ATMs we Need Right Now

The crypto ATM market is growing at an incredible rate According to market analysis, the global crypto ATM market is valued at 55 million USD in 2020, but it is estimated that by 2026, the value of the entire market could be as high as 220 million USD. By definition,...

Order a Bitcoin ATM

ChainBytes Universal + Top screen

From $6,700

ChainBytes Model V

From $4,999

ChainBytes Model V

From $4,999

ChainBytes Universal + Top screen

From $6,700